What if you could pay off your home in half the time, save tens of thousands of dollars in interest costs, have more monthly cash flow and become debt-free years sooner compared to the old way. Would you find that information valuable?

Most North Americans purchase their homes through regular amortized mortgages. On average, it takes anywhere between 25 to 35 years to pay it off. By the time the average North American pays off their mortgage, they have surrendered twice the original purchase price due to the heavy amounts of interest being charged.

Regular mortgages are also front end loaded with interest. This means for the first five years of paying a mortgage, home owners are paying mostly interest. Even if you are making biweekly payments, you are still paying mostly interest on the front end portion of the mortgage. It’s not the interest rate that kills you. It’s the volume of interest that will kill you.

May I politely remind you what the term mortgage means? It is French for “death contract” and that is exactly what it is.

When people negotiate a mortgage, they generally focus on just one thing; the interest rate. Yet the interest rate is a secondary issue.

The primary issue is “How do I change the principal to interest ratio in my favor?”

Enter the “all in one” banking systems. They were developed in Europe and Australia and it has proven to work.

The concept behind an “all in one” banking system is simple. Have your income and savings reduce your total debt faster by bringing your mortgage, debts, savings and income together into one multi-purpose simple interest lending and checking account. When you combine a simple interest loan with net out accounting, magic can happen.

Here is how it works.

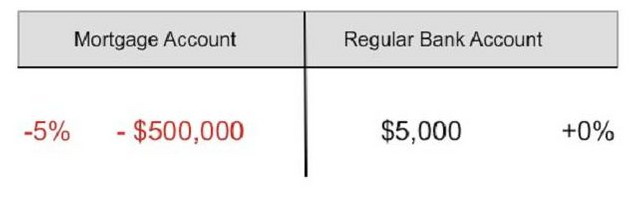

Let’s suppose you have a $500,0000 mortgage with a 5% interest rate. At the same time let’s suppose you are depositing $5,000 each month into a checking account which is earning practically 0%.

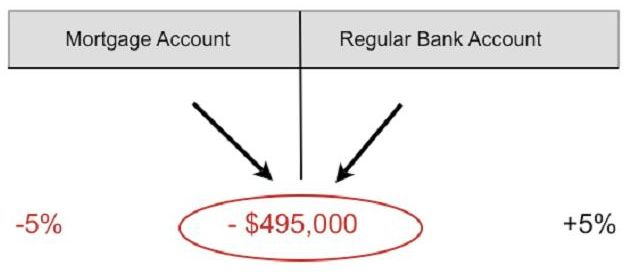

As long as the $5000 deposited each month is available for withdrawal, wouldn’t it make more sense to combine these two accounts together through a simple interest loan? This way, every dollar you earn from your income will reduce the outstanding principal.

Now you only pay interest on $495,000 instead of $500,000.

That’s the same as actually making 5% on your $5,000 tax free. And that’s a guaranteed rate of return because you have reduced your cost of borrowing and made your payments as tax efficient as possible.

Let’s compare apples to apples. If you decided to invest your $5000, you would have to find an investment that guaranteed you a 7.5% return on your $5,000 since you have to factor in taxes. In other words, you may be better off just leaving your money in your simple interest bank account, rather than investing it.

Each month, your $5,000 will immediately apply against your borrowings, thus instantly reducing your debt and saving you interest costs. And you can spend that money whenever you want on whatever you want (up to your full borrowing limit).

Obviously everyone has other monthly expenditures such as food, phone and electricity bills that will reduce the amount of money available in the account each month. But, as long as the monthly income you make is more than the monthly expenditures and monthly interest being charged on your outstanding loan, the principal balance will drop at a much faster rate compared to a regular amortized mortgage.

The overall result of using this banking system is that you will pay your home off in less time, save tens of thousands of dollars in interest, guarantee yourself a rate of return and increase your available cash flow.

Plus you have these added benefits

– You will immediately free up cash flow.

– You will immediately put your income to work.

– You will save tens of thousands of dollars in interest (on average)

– You will be debt free faster (as long as you are responsible with your cash flow).

– You can take advantage of other investment opportunities that come your way.

– You can protect a large portion your home’s equity value from major house market corrections and crashes.

– You have the option at any time to convert some or all of the principal of your home back into a regular mortgage.

– You will immediately free up cash flow.

– You will immediately put your income to work.

– You will save tens of thousands of dollars in interest (on average)

– You will be debt free faster (as long as you are responsible with your cash flow).

– You can take advantage of other investment opportunities that come your way.

– You can protect a large portion your home’s equity value from major house market corrections and crashes.

– You have the option at any time to convert some or all of the principal of your home back into a regular mortgage.

It’s all about flexibility and peace of mind and this is exactly what “all in one” banking accounts offer.

If you can’t find a financial institution that will offer you an “all in one” account, perhaps they will offer you some other form of Home Equity Line of Credit which you can deposit your monthly income into and withdraw when you need to pay for things.

An “all in one” banking system is not even a new idea. Europeans and Australians have been using this system for decades, and decades, and decades. Yet how much of the population actually understands the benefits of this system in North America? Apparently not enough.

Beware of Danger #4 for the 10 Dangers of Investing

DANGER #4 – MANY COMPETING FINANCIAL ADVISORS WILL TELL YOU THAT THE OTHER GROUP IS EITHER WRONG, MISGUIDED OR SCAMMERS…EVEN IF THEY ARE NOT AND THEIR INVESTMENT PRODUCTS ARE BETTER.

Here are some common arguments against using this banking system

“All in one” banks charge you $15 service charges each month for using this system.

My other bank or financing company can get you a lower interest rate.

My other bank or financing company can get you a lower interest rate.

- Response: $15/month is a reasonable fee for a more efficient banking system that allows you to pay off your home in half the time or less, increase your cash flow and reduce your cost of borrowing, thus saving you half the interest you would have paid to the other banks.

- Response: A response to them could be the response told to me by members of the Million Dollar Roundtable.

“It’s the order of returns that counts, not the magnitude.”

The interest rate is not the primary issue. With a regular mortgage, it’s the volume of interest that will kill you, not the rate. You are going to take a longer time paying off your home and have less cash flow to use. Plus, you will be paying all that front-end loaded interest while paying down very little principal.

An “All in One” account eliminates waste in your home payments, increases your cash flow, and pays down your debts faster. The numbers don’t lie.

“All in one” bank accounts come with one very serious warning.

This product is designed to increase your wealth and decrease your debt. However, you could have access to tens of thousands of dollars and sometimes hundreds of thousands of dollars in cash at your disposal to borrow from. If you happen to be someone that has an uncontrollable spending habit, then this product may not be for you.

If you cannot control your urges to spend money and you need these funds for your future retirement, here are three options for your consideration.

Don’t get it.

Limit the amount of the available home equity the bank will give you.

Put the extra funds in a secured financial vehicle such as an insurance annuity so you can’t spend it as easily, or maybe a whole life “banking” policy mentioned in the previous chapter. Or do both.

At least talk to a qualified financial advisor that can help you understand your situation.

Limit the amount of the available home equity the bank will give you.

Put the extra funds in a secured financial vehicle such as an insurance annuity so you can’t spend it as easily, or maybe a whole life “banking” policy mentioned in the previous chapter. Or do both.

At least talk to a qualified financial advisor that can help you understand your situation.

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment